Conservatives get another win after BlackRock kills ‘Net Zero’ climate policy

David Bahnsen, founder and managing partner of the Bahnsen Group, said that as companies reverse course on DEI and ESG investing, UFC CEO Dana White has joined the Meta board and is underway. They joined ‘The Big Money Show’ to discuss the California wildfires.

BlackRock, the world’s largest asset manager, recently withdrew from a prominent climate change policy with the Net Zero Asset Managers Initiative (NZAM), which is committed to achieving net zero greenhouse gas emissions by 2050.

The firm said last week that the membership had “created confusion about BlackRock’s practices and led us to field legal questions from various government officials.”

The management agency stated that the current investment portfolio managers will “continue to evaluate the risks related to the material climate”.

California drivers brace for possible gas price hike after approval of higher climate standards

BlackRock Releases Net Zero Climate Commitment (Young Making/VCG via Getty Images)

Meanwhile, Will Heald, president of the nonprofit Consumer Research, told Fox Business that he was fired in the wake of a major lawsuit against the asset management company.

In Spence v. American Airlines, Inc., a federal court found that American Airlines and certain employees breached their statutory responsibilities under the Employee Retirement Income Security Act (ERISA). The breach involved offering BlackRock-managed index funds such as the S&P 500, Russell 1000 and Russell 3000 within the company’s 401(k) plans. Heald said the ruling raises concerns that other businesses offering similar funds could face similar legal challenges.

California taxpayers are paying nearly $20 million for a wireless charging project at UCLA

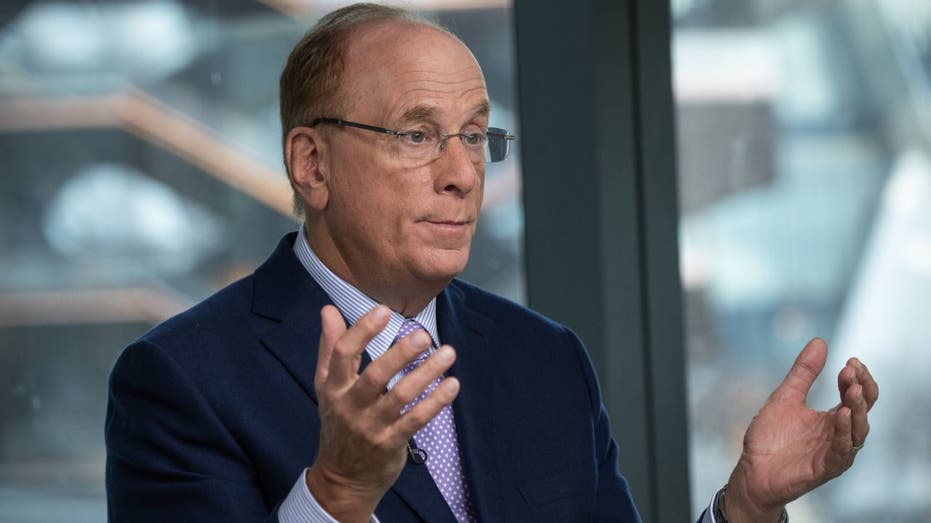

BlackRock Inc. Chairman and CEO Larry Fink is shown here. BlackRock withdrew from the NetZero initiative. (Victor J. Blue/Bloomberg via Getty Images/Getty Images)

In a letter to every Fortune 500 company about potential risks associated with BlackRock, first obtained by Fox Business, Hild wrote: “Despite BlackRock exiting one of its net zero mergers last week, the firm has proudly said it will not exit.” Change the way… we (clients) manage portfolios.’ And BlackRock maintains its membership of the UN PRI, where it pledges to incorporate ESG issues into proprietary policies and practices.

“Therefore, they are at risk of breaching their obligations by continuing to entrust plan assets to BlackRock,” the letter said. “In conclusion, any corporation or company that uses BlackRock to manage their pension plans is now fully aware that BlackRock has already served a dual purpose and is still publicly committed to doing the same.”

After 2021, following the United Nations Climate Conference, “Net Zero” commitments have been expanded. Conservative lawmakers generally oppose these policies, especially as they can hurt the economic growth of power-producing states. They often criticize policies that they call “crowdfunding capitalism,” citing the potential for high energy costs, job losses in traditional energy sectors, and unnecessary government intervention.

Companies tout ‘NET-ZERO’ climate targets, but few have credible plans, reports find

BlackRock headquarters in New York, US, Wednesday, Dec. 27, 2023. (Angus Mordant/Bloomberg via Getty Images/Getty Images)

Hield told Fox Business that he believes President Donald Trump’s victory will encourage some of these left-wing startups to roll back, but the antitrust issue is likely to be the reason for pulling out of the Net Zero commitment, as the company has only paid back a portion of its pledges.

“I care about the shareholders, but I care more about the consumers,” Hild said. “The problem is that all this ‘Net Zero’ stuff adds costs and has to be passed on to the consumer,” Heald said. “It’s about raising costs everywhere, from the gas pump to the grocery store, and it’s a big contributor to inflation.”

Get FOX BUSINESS on the go by clicking here

An NZAM spokeswoman told Reuters that the move was disappointing and that “climate risk is a financial risk”.

“NZAM exists to help investors reduce these risks and help realize the benefits of the economy to net zero,” the spokesperson said.

Fox Business contacted NZAM for further comment but had not heard back by publication deadline.